I can finally call myself DEBT-FREE, with the exception of my mortgage and my car loan which I am working to pay off early, and DAMN does that feel good! I recently learned that the average American is $38,000 in debt, and that is terrifying. Regardless of how the debt was accrued, NOW is the time to start digging out and building a brighter future for yourself.

I was totally content with a couple grand chilling on the credit cards at any given time, because it allowed Chris and I to continue living a “cushy” life. Sure, we paid interest every month, but since I didn’t budget or keep track, it was easy to pretend we weren’t throwing away HUNDREDS of dollars each month. I never felt like our debt was “out of control” so I didn’t work very hard to get rid of it. Every month I would pay off hundreds of dollars, and every month we’d rack it right back on there. It is too easy to do, really. I was also throwing maybe $100 a week (I get paid weekly) into our savings and thought I was doing the right thing….

I finally realized that in order to truly take control of our lives, I had to be in absolute control of my money. When tax season came around this year, as well as a paycheck for Chris’s side work, and a few other stars aligned, we realized that we had to put all of that money straight into the credit cards and come up with a plan to get rid of the debt for good. We drained our savings that I had built (GULP), took every cent of that income and tax return, and had a plan to finish paying off whatever was leftover. I would say my biggest help on choosing which card to pay off first and what the best steps to do with my money have come from Dave Ramsey and his baby step system.

At this point, I am successfully out of step 1, finishing up step 2 by paying off my car loan early (SO CLOSE), and simultaneously building steps 3 and 4. Now that I think about it, I think the biggest reason why I knew the debt had to go is because Chris and I are not getting any younger… and that retirement age is creeping up FAST (holy shit), and we had nothing to show for it. NO BUENO. Step 3 is going to take me a while to build a 3-6 month backup fund, but I feel step 4 is important too, so here is what I am currently doing:

1. Taking 10% of our income post-taxes and putting it straight into a savings account until I have “enough” built up to put into a Roth IRA, at which point we will find our best course of action. 2. Moving $100 per week (we get paid weekly) into our emergency savings fund. 3. Any extra leftover each week is applied to car note.

With this course of action, my car note should be paid off near the beginning of 2020 (approximately a year early), our savings will continue growing and will take a WHILE to get to the 6 month goal, and our retirement will continue to grow without doubt. Once the car note is paid off, I will take that money and directly start depositing it into a third savings account for the next car purchase, the goal being to pay cash for whatever car we purchase next. A car loan is the single worst investment you can make with your money, aside from a few BIG DOLLAR car purchases.

But what brought you all to this blog post, HOW I have kept us out of debt since paying off the credit cards, and how I plan to make us millionaires by the time we retire. BUDGETING!!!!

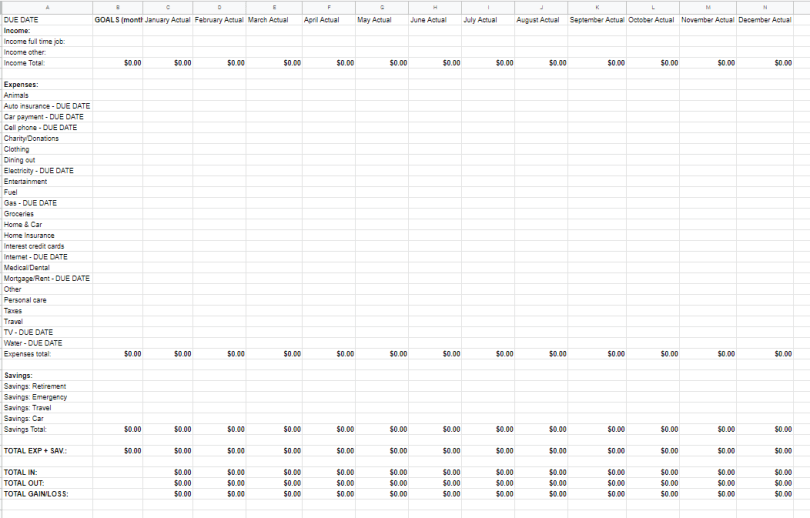

I created a budgeting system in a google spreadsheet that I now update religiously to keep us on track. The first column in the spreadsheet are the GOALS that I want to achieve. This is how we stay on track. Then there is a column for each month of the year following that.

The first rows of the spreadsheet are income totals, followed by a section of outgoing expenses broken into categories, followed by savings accounts, and lastly a incoming vs outgoing total.

You can click the image above or click this link here to view the google spreadsheet where you can COPY and paste the entire thing into your OWN Google spreadsheet for it to function, or just print and write on if that works better for you. I have set up the auto-sums to automatically add up totals for you if you decide to copy/paste the whole document.

First thing I would advise you to do is enter your current income amount in the GOAL cell of B3, and then in the same column enter all of your KNOWN expenses in column B(such as mortgage, cell phone bill, car loan, utilities, Netflix, etc.) and then put their due date where it says in column A. This will allow you to see how much is coming in and how much is DEFINITELY going out, and whatever is left over can be divided up among the rest of the categories. This is also a great time to assess your bills and see where you can begin reducing!! Have too many subscription services? Cancel at least one. Is your cell phone bill too high? Start shopping around for new plans.

Once you have all of your monthly goals filled in making sure that it does not cost MORE than you are making, then starting NOW you can start to budget for the month for each category. For example if you only budgeted $20 in new clothes each month, then you better damn well stay under that or take it from another category. NO MORE SPENDING MORE THAN YOU EARN!!!

My next suggestion is to print all of last month’s statements (your banking, credit cards, loans, etc.) and fill out LAST MONTH’S budget column (for example, fill out July’s if you are reading this August) so you can start to SEE where all of your money went last month. TALK ABOUT EYE OPENING!!!! Now you know where you need to correct course the most and where maybe you are doing better than you thought… (ahem, eating out costs SO MUCH FREAKING MONEY).

I encourage you to edit/change/adapt this spreadsheet to work for you + your family, but use it as a baseline. I think this covers most of the bases for families and everything should be able to fit into the categories listed. Then, start using it!!! I have my spreadsheet bookmarked to the top of my tool bar and I stare at it. A lot. I know what bills are coming out and when, and I know how much money I have each week to spend and on what. It is so freaking helpful. Because of this system, I have maintained a zero dollar balance at the end of each statement period on all of our credit cards since February of this year (so 6 months now)!!!

Need help editing your spreadsheet to make it work for you? I’d be more than happy to help, just send me an email to katy.english1@gmail.com and let me know how I can help. Obviously I am no money expert, and am still learning each month, but I’m always happy to share the path I have taken and what I have learned along the way. Also feel free to share this with a friend. The more people out of debt, the less power that “the man” and our government have over us, and the more powerful THE PEOPLE become!!!!

Hope this helps! xoxo Katy